Payroll & Expenses

Compliance

Adhering to Rules and Regulations

Statutory compliance is mandatory for businesses around the globe. Configure the statutory details as per the rules of the state and relax

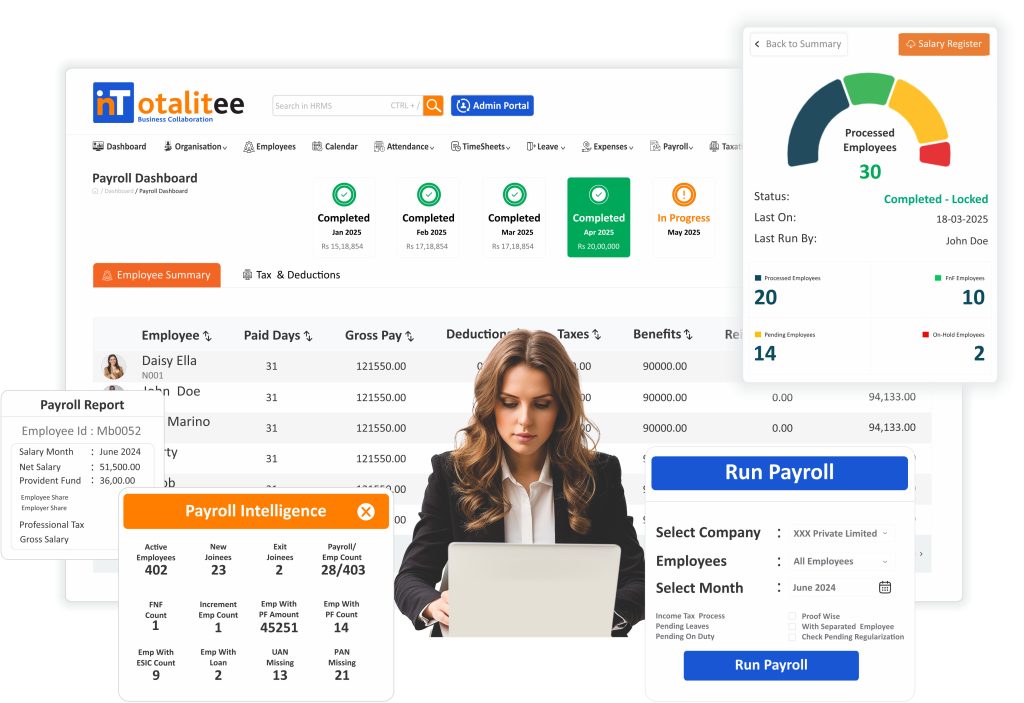

Payroll Software

Advanced smHRt Payroll with Automated Compliance Handling

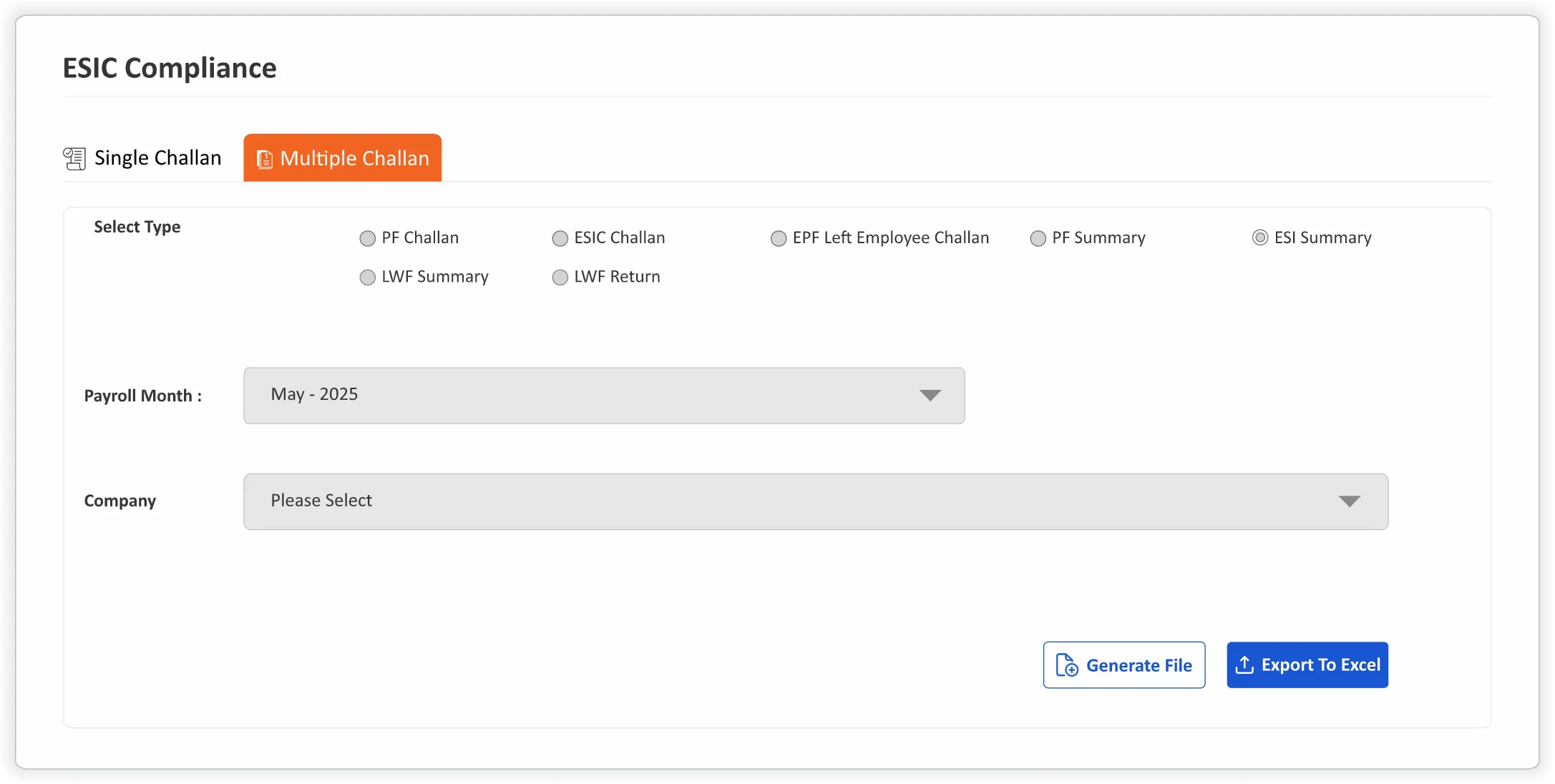

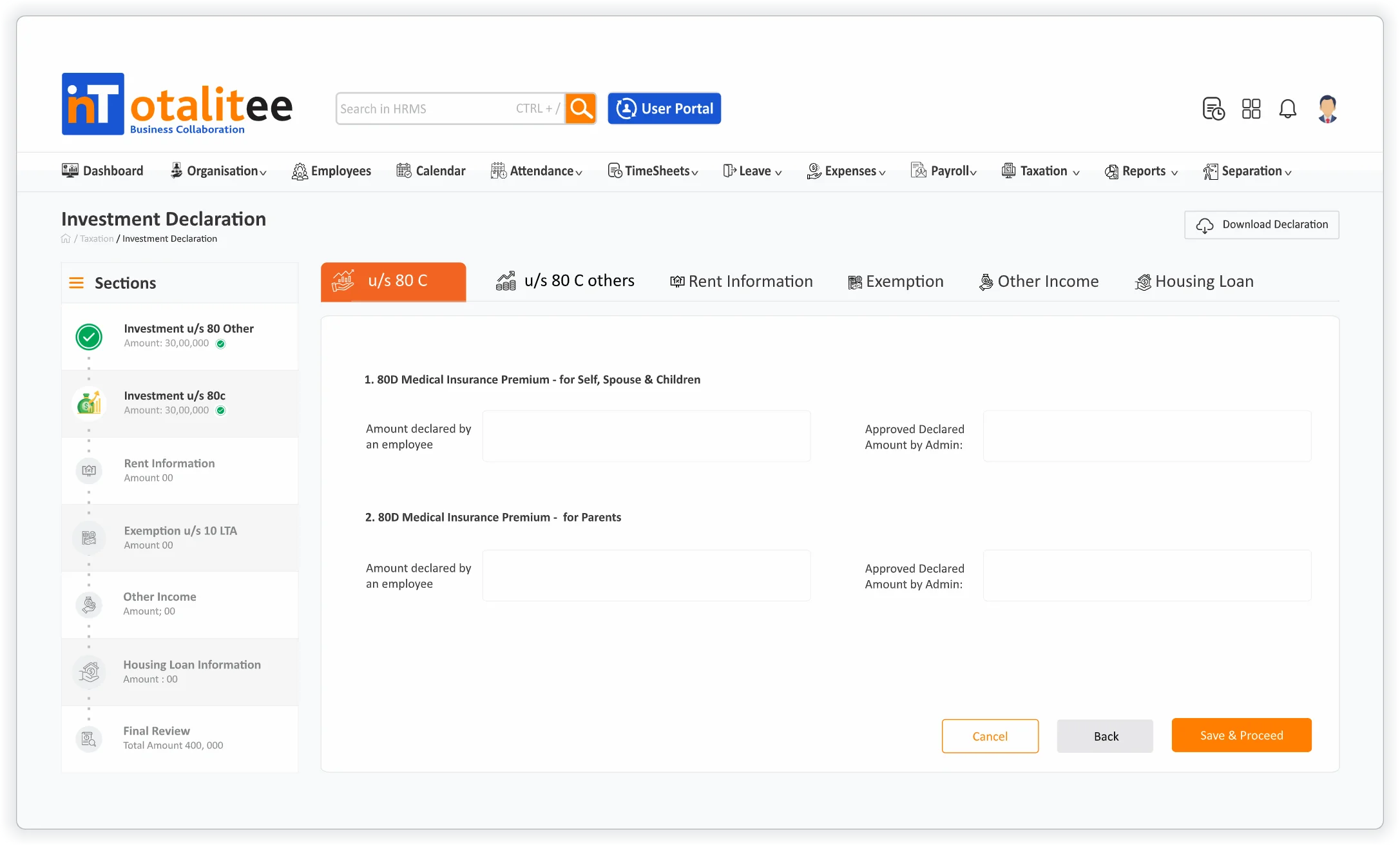

Managing statutory compliance is a critical responsibility for any HR and Payroll team. Errors, delays or omissions can lead to penalties and loss of employee trust. With Automated Compliance Handling in inTotalitee, your organization ensures real-time, error-free adherence to all major statutory requirements—without manual tracking or repetitive administrative effort. This module centralizes and automates compliance for PF, ESI, PT, LWF, TDS, and other labor laws, making your payroll process not only smoother but fully audit-ready.

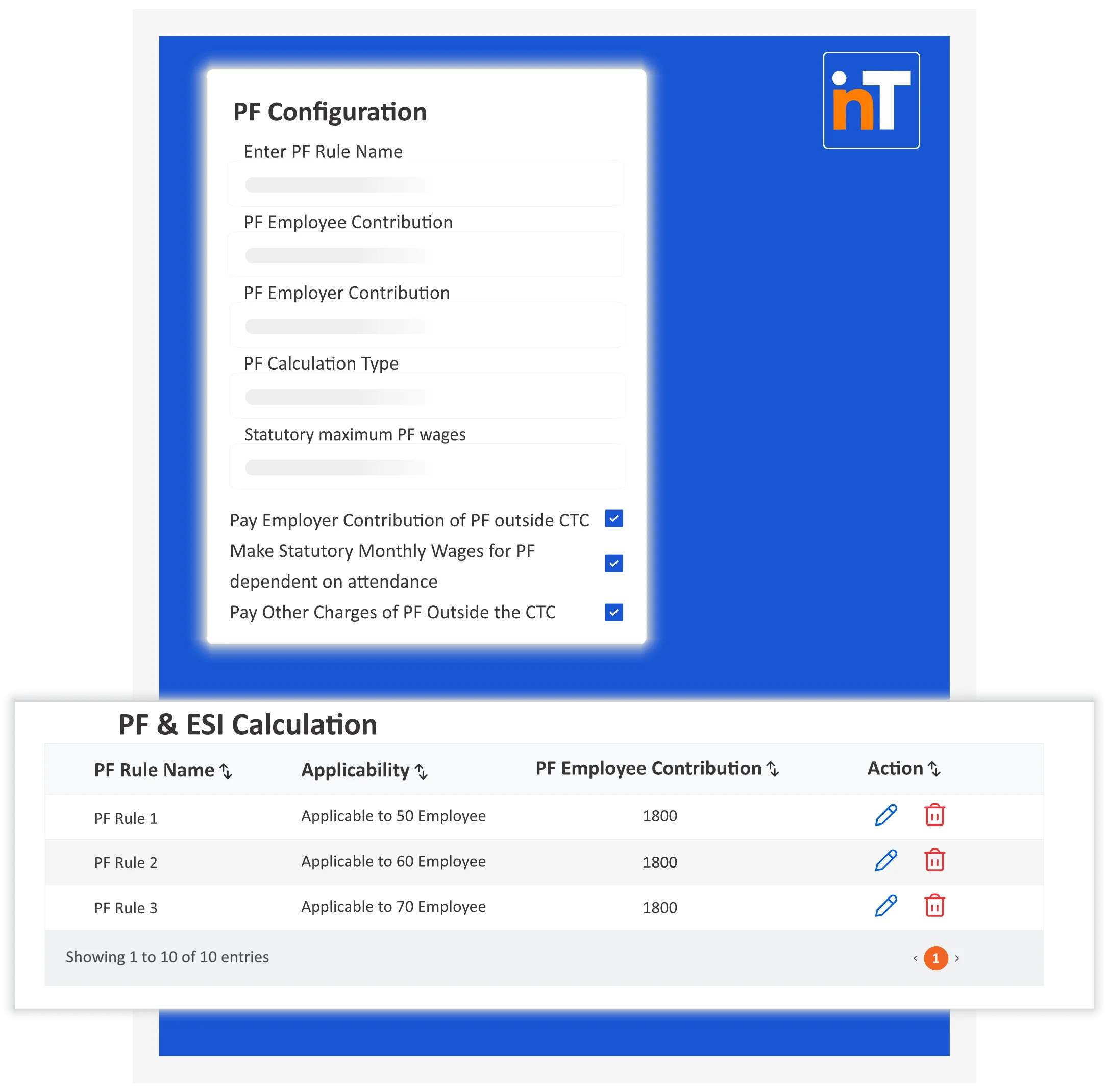

PF Compliance

Employee Provident Fund (EPF) - Improves Employee Welfare

Set up your provident fund rules based on employee salary ranges or management bands. Configure provident fund to be part of CTC or outside CTC. inTotalitee automates the management and reporting of PF contributions, ensuring your organization meets all statutory requirements with minimal manual effort. By integrating with payroll and employee data, system calculates contributions accurately, generates compliant reports and streamlines monthly filing processes—reducing errors and ensuring complete regulatory adherence.

"Minimize Risk and Maximize Confidence with an HRMS That Keeps You Always Audit-Ready and Fully Compliant."

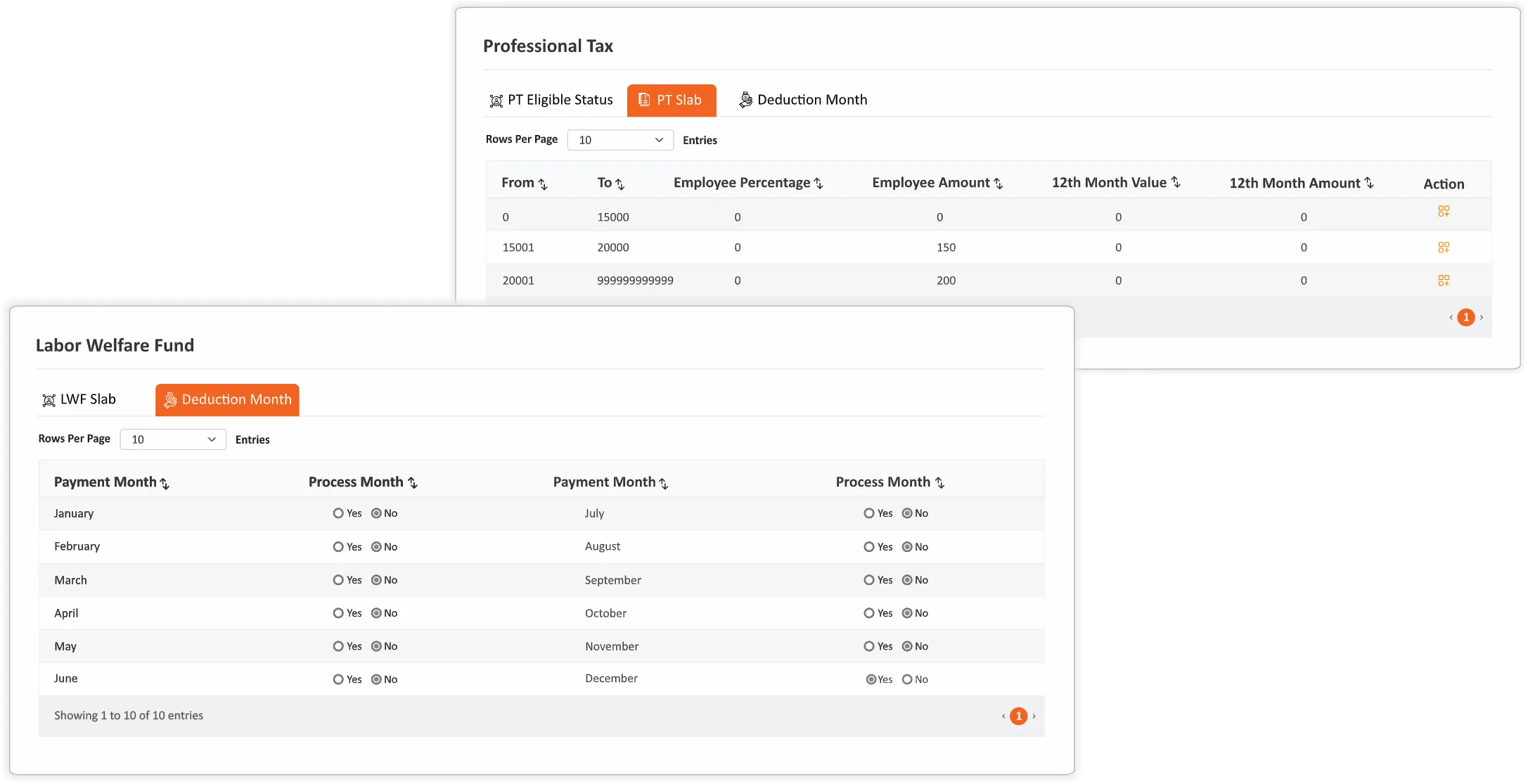

PT and LWF Compliance

State Specific Rules for Professional Tax

Managing statutory deductions like Professional Tax (PT) and Labour Welfare Fund (LWF) is critical for organizational compliance. With inTotalitee, both PT and LWF compliance are automated and seamlessly integrated into payroll, ensuring accurate deductions, timely filings and zero manual effort. By streamlining these state-mandated contributions, inTotalitee helps organizations stay compliant across regions while maintaining transparency and trust with employees.

Frequently Asked Questions

What is Lorem Ipsum?

Lorem ipsum dolor ist amte, consectetuer adipiscing eilt. Aenean commodo ligula egget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quak felis, ultricies nec, pellentesque eu, pretium quid, sem.

Why do we use it?

Lorem ipsum dolor ist amte, consectetuer adipiscing eilt. Aenean commodo ligula egget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quak felis, ultricies nec, pellentesque eu, pretium quid, sem.

Where does it come from?

Lorem ipsum dolor ist amte, consectetuer adipiscing eilt. Aenean commodo ligula egget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quak felis, ultricies nec, pellentesque eu, pretium quid, sem.

Why do we use it?

Lorem ipsum dolor ist amte, consectetuer adipiscing eilt. Aenean commodo ligula egget dolor. Aenean massa. Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Donec quak felis, ultricies nec, pellentesque eu, pretium quid, sem.

Ready to try inTotalitee

With tools to make every part of your process more human and a support team excited to help you getting started with a growth engine for your employees has never been easier